Sustainable Financing

SUSTAINABLE FINANCING

Our banks drive sustainable growth by funding green projects, national infrastructure, and supporting MSMEs, while promoting financial inclusion and empowering Filipinos with financial knowledge.

How we're doing

Green Financing

Blue Bonds offering

ASEAN Sustainability Bonds issued by BDO

First-ever Gender Bonds

Total sustainable finance projects funded to date by BDO

Infrastructure Development

Loans disbursed by BDO for airports

Loans disbursed by BDO for road networks

Loans disbursed by BDO to national projects

Loans disbursed by BDO for railways

Inclusive Growth

BDO and China Bank SME loans granted

Participants attending the financial literacy

Female MSME Loan Clients of BDO Network

Cash Agad Partner Agent Sites

BDO

Driving Growth and Creating Opportunities

Banks play a crucial role in helping people and businesses thrive. Whether it’s providing loans to entrepreneurs, assisting families secure their future, or making everyday banking easier, financial institutions keep the economy moving. They enable businesses to expand, jobs to grow, and communities to flourish.

At BDO, growth goes hand in hand with purpose. By supporting enterprises, expanding financial access to Filipinos and financing worthwhile initiatives, the Bank helps create meaningful opportunities. From funding clean energy to bringing banking services in underserved areas, BDO is committed to growth with purpose – ensuring that progress helps uplift lives.

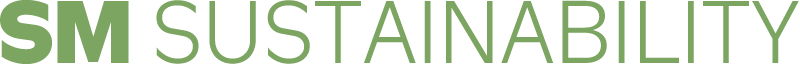

Empowering Growth through Sustainable Finance

As a pioneer in sustainable finance, BDO continues to fund large-scale projects that drive economic development while reducing the country’s carbon footprint. This means supporting key industries that boost local economies while contributing to a more sustainable future. BDO has financed PHP1.04 trillion in sustainable finance to date, including 63 renewable energy projects nationwide and in other parts of Asia.

In 2024, BDO successfully issued its second and third ASEAN Sustainability Bonds under the BDO Sustainable Finance Framework (SFF) to finance green and social projects, ranging from renewable energy to clean transport and sustainable agriculture and fisheries.

The overwhelming support from retail and institutional investors for these financial instruments, issued at record highs of PHP63.3 billion and PHP55.7 billion, respectively, reaffirms confidence in BDO’s leadership and credibility in sustainable finance.

BDO’s SFF is currently the most comprehensive framework in the Philippines for Green, Blue, Social, and Gender financing, with 29 eligible categories certified with a Second Party Opinion by Morningstar Sustainalytics.

Investing in a Sustainable Future through BDO Private Bank (BDOPB), in collaboration with Branch Banking Group (BBG), played a key role in the success of the ASEAN Sustainability Bonds, significantly increasing both retail and institutional client investments from PHP3 billion in 2023 to PHP20 billion in 2024.

BDO remains committed to raising awareness among its stakeholders about how BDO leads sustainable initiatives whenever possible – championing resource preservation and creating lasting benefits for future generations.

BDO Network Bank: Empowering Entrepreneurs through Microfinance

Spreading Financial Inclusion for All

By continuously expanding its physical and digital reach, BDO has bridged financial gaps for underserved and unbanked communities. Through financial literacy programs, the Bank equips individuals and Micro, Small, and Medium Enterprises (MSMEs) with the knowledge and skills to manage their finances effectively, empowering them for long-term success.

CHINABANK

Banking That’s Focused on You

At the heart of Chinabank’s enduring relationships is our dedication to knowing our customers well and providing them the banking support and solutions best suited to their financial needs, goals, and circumstances.

This unwavering customer focus is in our company DNA, manifested in the way we take care of our customers, and drives Chinabank’s growth and resilience.

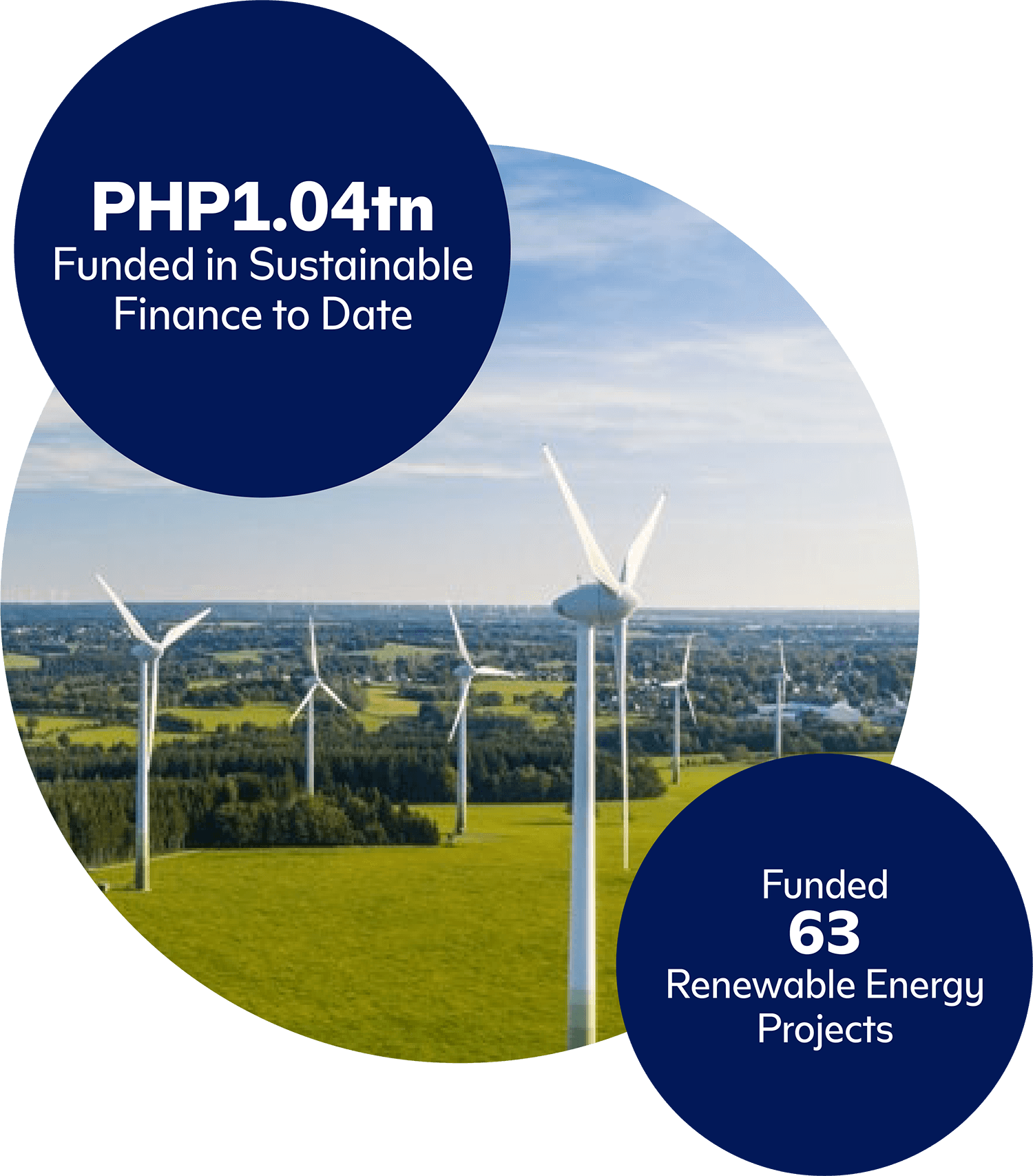

In 2024, we achieved an all-time high consolidated net income of PHP24.8 billion. We are still the fourth largest private universal bank in the Philippines, with total assets of PHP1.6 trillion. Deposits hit PHP1.3 trillion as we made account opening and saving easy and convenient. Gross loans reached PHP933 billion as we improved the loan process and enabled easier access to financing for more people and businesses.

Empowering a Sustainable Future

As we empower Filipinos to navigate their financial futures with confidence, we also work to build a sustainable future for all. We support renewable energy projects and initiatives that promote resource efficiency and reduce greenhouse gas emissions, while actively managing our own environmental footprint.

In 2024, Chinabank was honored by The Asset for excellence in ESG practices. We were also named to TIME’s list of the top 1,000 companies globally for employee satisfaction, revenue growth, and ESG performance. We again received the Five Golden Arrows award from the Institute of Corporate Directors—affirming our strong corporate governance.

Looking ahead, we remain committed to operating with integrity, care, and accountability. As we move forward, we will continue to sharpen our focus on sustainability—leveraging our financial strength, expertise, and values to make a lasting impact on our customers, communities, and future generations.